Off late many of the platforms in India have been pushing the punchline Invest In US stocks and many of the investors are lured by fancy American companies. All of this looks very attractive and fancy , but the issue is the risk associated with it and taxation which many of us are not aware off.

Biggest Risk in Investment is not understanding the known risk.

Before venturing into International investment following key points needs to be considered

- Estate Taxes : USA imposes estate tax on any USA assets held ( cash + securities listed in USA ) on holdings >60k USD on demise of investor : Any asset over and above 60K USD would be subjected to 40% with holding tax.

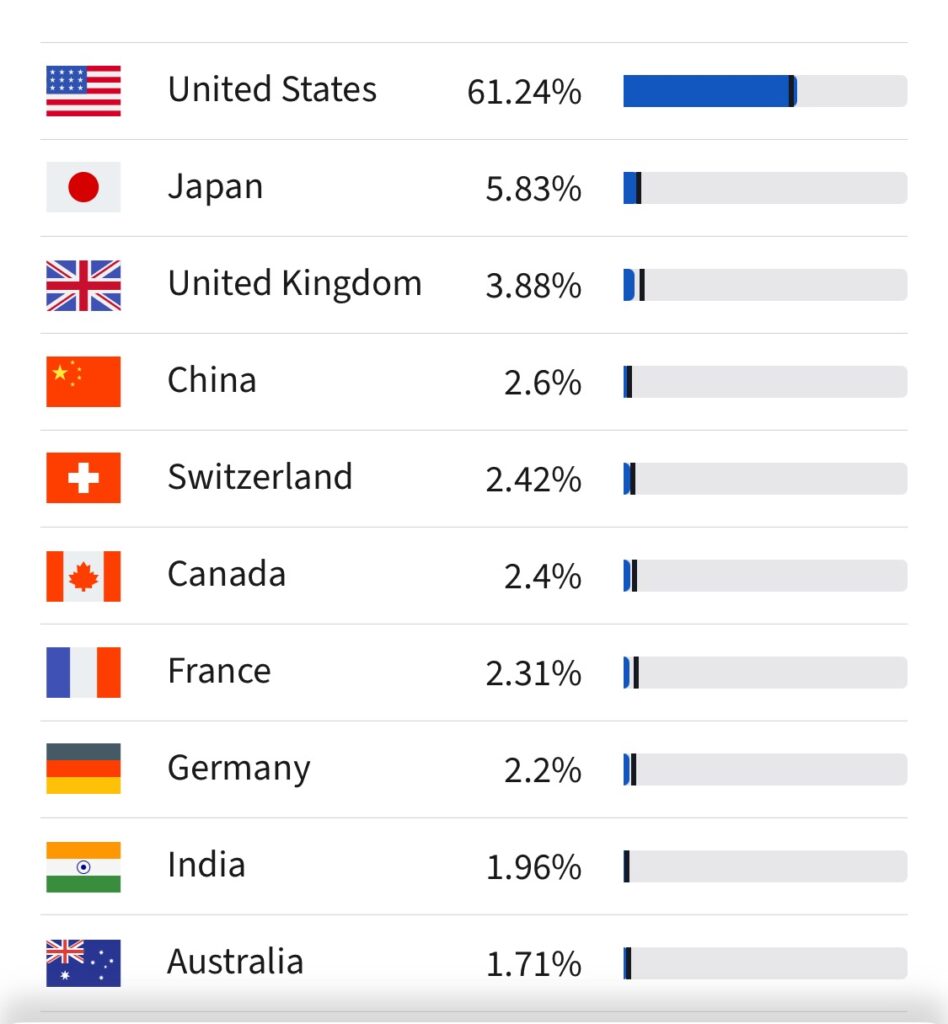

- Global Investment is not all about Investing in USA market other then Indian market.

- Majority of Brokers offering their services are USA based brokers and again the USA regulations would apply

- Cost of funding overseas broker : Funding overseas broker account needs INR to be converted into foreign currency ( majority of times its USD ) , now this involved currency conversion charges which can range from 2-4% depending on bank one uses to initiate transfer.

- Tax Collected at Source : To find the overseas broker , one needs to use the Indian banks to electronically transfer funds, now 5% of amount is deducted as Tax collected at source ( TCS ) and this amount is locked in till time of tax filling or adjusting against TDS.

After having analysed the above important issues if one’s goal based investment still needs global diversification then one can consider following strategy.

- Buy Non USA domiciled Funds / stocks from USA broker

- Buy Non USA domiciled funds/ stocks from Non USA based broker

Option two would completely avoid Estate taxes. Some of the recommended options platforms to consider are

INTERACTIVE BROKERS LLC

It’s a USA based broker providing access to multiple markets across the globe.

Click on this link to open the account

https://ibkr.com/referral/deepak757

Advantage

- Easy account opening online

- One can buy non USA assets

- Low brokerage

Disadvantages

- USA based broker and remote possibility of estate taxes and complicated IRS protocol applies

- The platform is loaded and quite complicated for beginner

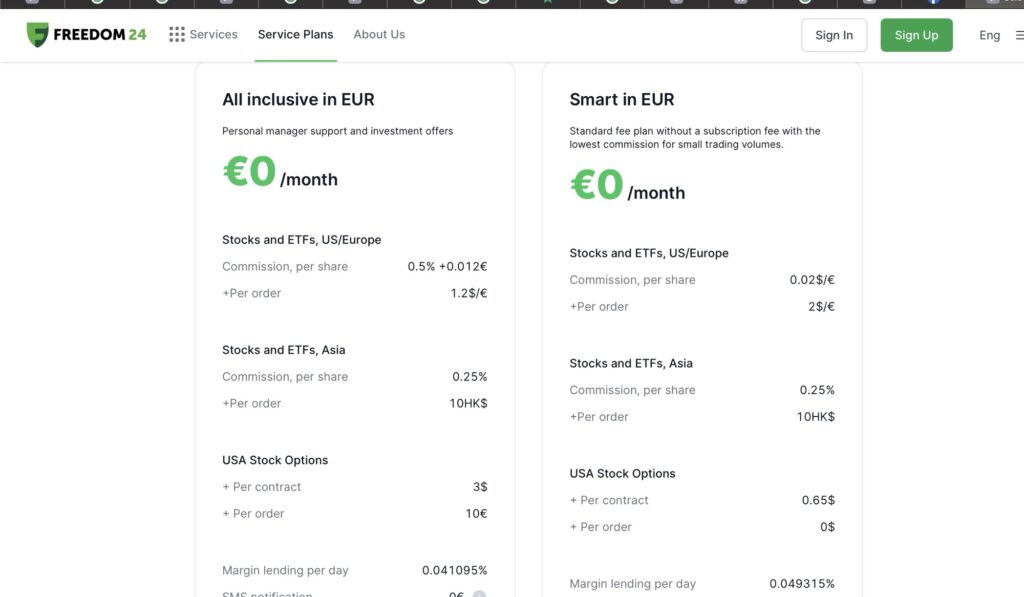

FREEDOM24

It’s an European based broker providing services to many of investors worldwide including resident Indian investors.

You can open up the account by clicking on the link below

https://freedom24.com/invite_from/11868527

Advantages

- Online account opening

- Provides access to Resident Indians

- European based broker and offers immunity from Estate taxes if one can stick to Non USA based assets

- Brokerage is very cheap and transfer out of funds is quite economical

- Free funding and no incoming fund cost

SARWA INVEST

Indian resident can open up account with them and opt for Sarwa Invest : it offers tailor made globally diversified portfolio and insulates one from Estate taxes. Here is the link

https://www.sarwa.co/invite/KALTAR4978

Advantages

- Online account opening

- Good for beginner especially if one wants tailor-made globally diversified equity and debt portfolio

- No research needed

- Simple and user friendly platform

Disadvantages

- No individual stock or etf selection ( one needs to use Sarwa trade )

- Higher cost

There are many more brokers ( European ) but as resident Indian, it’s technically very difficult to open account with them. If someone has necessity of true global diversification, can consider the above platforms.

Do post in your queries on comment for any further information

Happy investing

Together We Progress